Executive Summary

In any enterprise which has teams working in different domains needs to maintain their data using multiple systems. To synchronize the flow of data from one system to another can be challenging. Sometimes, this data is managed manually across the system because of a lack of interconnectivity. Such was the case at our client which specializes in the Financial Services domain based out of Florida. Our client used a tailor-made CRM system for the sales and service department whereas the accounting is taken care of using QuickBooks.

The Challenge

The sales and servicing departments used the CRM for all their workflow, which also need to have the client payment information to drive their process. The sales team used to enter the payment information in the CRM. Different clients have different payment schedules based on the services availed by them.

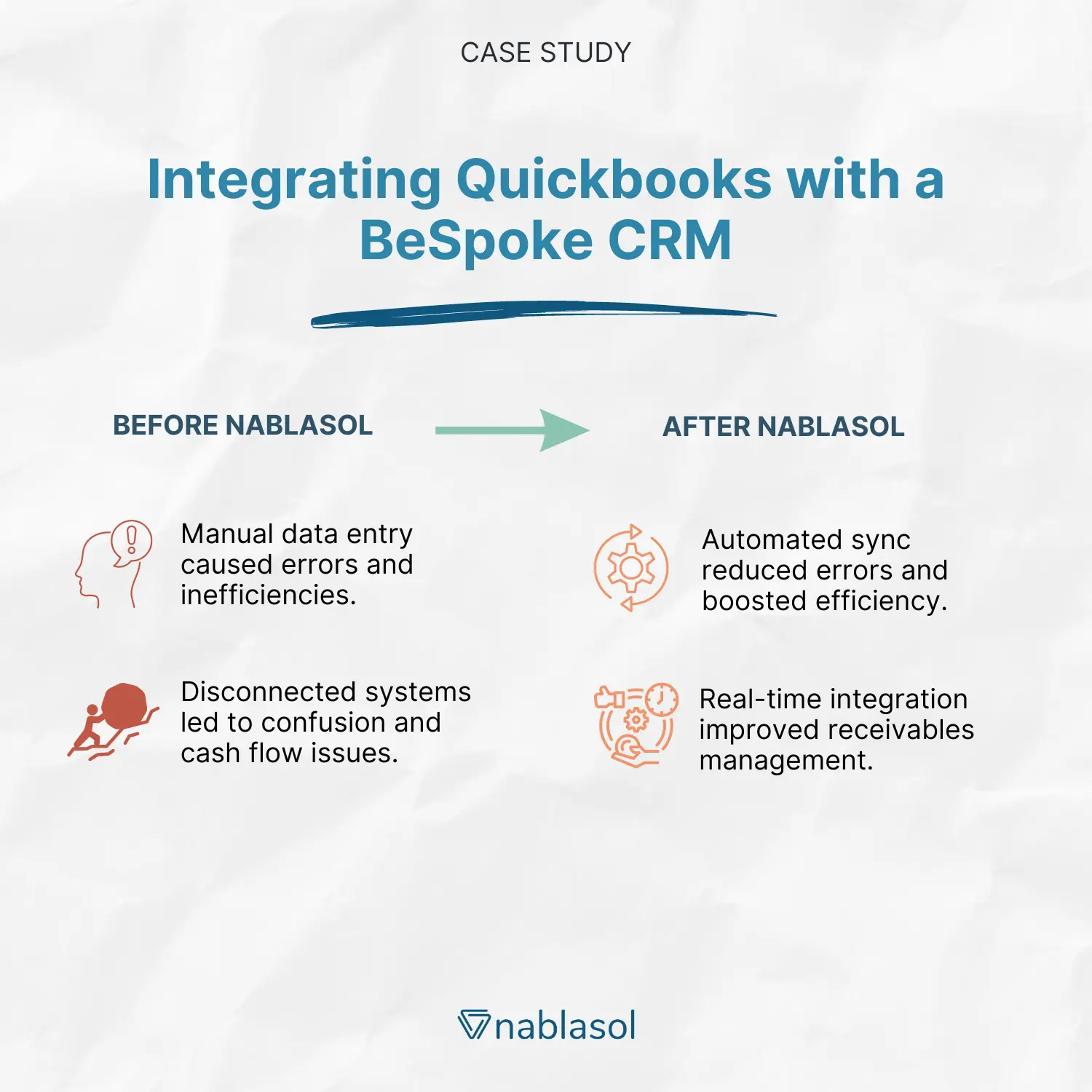

This had to be updated by the accounts department in the QuickBooks desktop application under the client file with the amount paid for the service that was availed. This was carried out manually by copying the data from the CRM to QuickBooks. There are high chances in such a situation where either the manual task can create errors while updating the amount from one system to another or scheduling the next due date for the respective client.

The client’s payment information was also needed by the back-office servicing team as some of their workflows were driven by the status of the client payments. Having the client payment information in two different systems used by different departments led to a lot of problems. Incorrect info in the system can confuse the team, cause irregular cash flow for the organization, and result in a bad customer experience.

Our Approach

We studied the thorough process of these departments as to how the transaction happens and how it is stored in the system in both systems. The obvious loophole identified was the lack of system interconnectivity which we took up as a challenge to solve. Before that we had to study the tailor-made CRM solution to understand the flow of data and how can the API of QuickBooks be integrated without causing any loss of data.

Here is the solution Nablasol built:

- Link QuickBooks client to CRM client by generating a unique client ID that gets matched between both the system.

- A tool was used to generate QuickBooks Intuit Interchange Format (IIF) files which helped enter the client information and their recurring payment schedules.

- A dynamic dashboard was built inside the client CRM to display the real-time payment data directly from QuickBooks.

- In case of unsuccessful payment or late payments, a nightly job to mark the payment schedule as pas due in the CRM system to intimate the servicing department.

- Built a job to push the client payment summary generated from QuickBooks to a data warehouse for reporting purposes.

Business Impact

Integrating the CRM with QuickBooks following results were achieved:

- Automation of the critical accounting process by linking the client payment information from the CRM to QuickBooks helped reduce the errors caused due to manual data entry.

- Improved efficiency for accounts receivable department, since they don’t need to go back and forth between QuickBooks and CRM.

- Better management of client receivables due to the synchronization of data between systems.